Page Contents

The Reconciliation Report

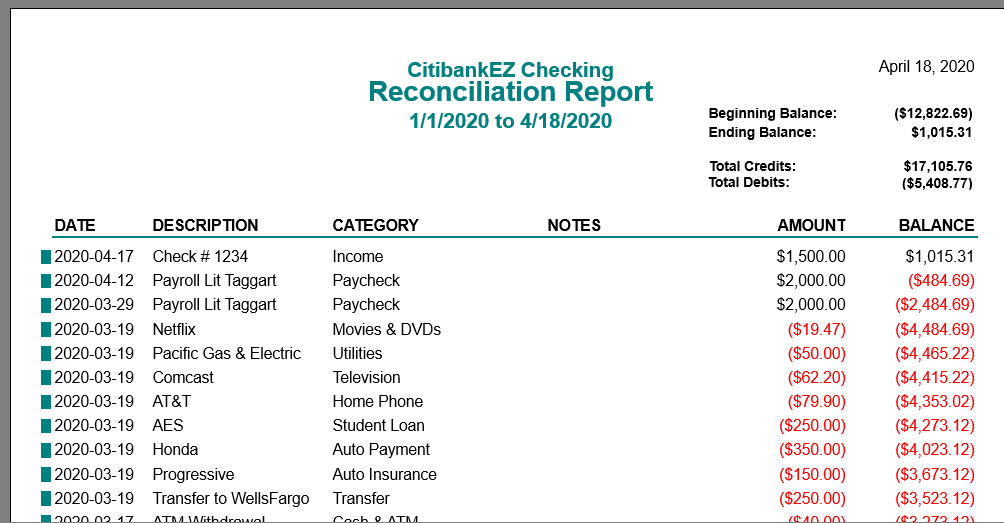

The Reconciliation Report is an amazing report. Since I decided to leave both Quicken and Quickbooks, I just have relied on Mint having the correct transactions listed. I go through them each year and make any changes necessary. But the thing is, are there duplicate or missing transactions? Did Mint get it all? When basing your taxes, person or business reports, accuracy is the key and there has to be some sort of reconciliation.

Well, now there is, and its not your Mom and Dad’s old reconciliation of getting out the calculator, checks, and receipts. It is just a matter of running a Reconciliation Report for your account.

Reconciling your Accounts

To reconcile Mint’s transactions, Just pull out a statement and run this report using both your opening and ending bank statement dates.

Monthly Reconciliation

In the Reconciliation Report Box:

- Enter the account you wish to reconcile

- Enter the Ending balance as displayed on your statement

- Enter the last day of your statement

- Enter the starting date of the statement period

The report will calculate your beginning balance. Just verify this against your statement.

Annual Reconciliation

In the Reconciliation Report Box:

- Enter the account you wish to reconcile

- Enter the Ending balance as displayed on your December statement

- Enter the last day of your statement

- Enter the starting date of the January statement

The report will calculate your beginning balance. Just verify this against your January statement.

Using Mint’s balances for your report

You can use the current balance using the amount displayed in Mint. But, keep in mind, each Financial Institution handles how they display or give their account balances to Mint differently when it comes to pending transactions. Some will include all transactions, pending or not, it the Account Balance that is displayed on the Overview page on Mint’s site. Some will not add the pending transactions to the balance.

So while you can use Mint’s balances, the report might not be accurate. This is especially true for credit cards.