When I was managing 80 rentals for my Dad’s Property Managment business, we bought a $2000 program specialized in property management. Since the State of California has strict laws for handling money for property owners, it made sense. But when you are managing a few of your own, it is overkill. The biggest mistake property owners make when it comes to renting their properties is proper reporting.

That is one of the main reasons I created MintToReport was to help me keep a handle on my rentals. Here is how I do it. Hopefully those that have rentals might find this setup more convienent then the way they are doing it now.

- I create a TAG for every rental property I own. I keep it simple and use the Address Number of the property as a TAG. For instance, 123 Main Street, I create a tag called 123. If it is a multi unit property, I create multiple TAGS (123-A, 123-B and so on).

- When ever I receive a rental check and make a deposit, I tag that depost as 123 and categorize it as ‘Rental Income’. If I deposit more then one check, I use Mint’s Spit feature to split the deposit by each check. This lets me tag each property correctly.

- Now, instead of step #2, my bank lets me use my phone to deposit checks. So I take 1 picture of each rental check and deposit it that way individually. Then I don’t have to split the deposit. I just have to tag and categorize each one. And it also shows up on my Bank Statement as one deposit. Great if I go to court on an eviction.

- When I recieve a Deposit for a rental, I tag it with 123 and categorize it as Rental Deposit under the Equity Category Type. I do this because deposits are always the tenants until I use them for unpaid rent or repairs when they move out. I also don’t want deposits to show as income.

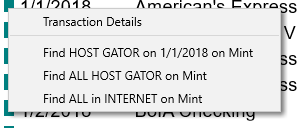

- When ever there is a repair done on a property, I tag that transaction as 123 and also tag it as ‘Tenant_Responsible’ or ‘Owner_Responsible. Always use underscores or hyphens when you create tag on Mint, or they get seperated when imported into MintToReport. See this post on why you should do it that way: https://minttoreport.com/mint-com-exported-tags/.

- I also create a Category for ‘Unpaid Rent’ and manually add a transaction in Mint for these. I only do this when a tenant moves out. After the Tenant has received there moveout accounting, I remove the fake transaction from Mint. I guess I could create a fack cash account for these, but I don’t currently. Again, I only put it in Mint so I can show it create a move out accounting report for the tenant.

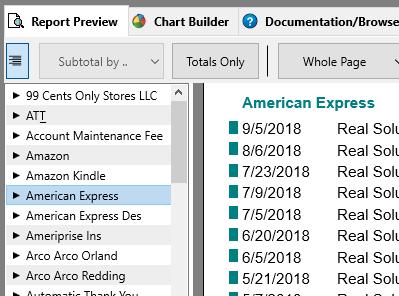

Now following these steps, I can easily, at any time, create individule profit and loss statements for each property. I can create a Tag report and select the property tags for the month or year which is nice for having one report showing all income/expenses per property on one report. In fact,

When a tenant moves out:

- I run a Income Expense Report

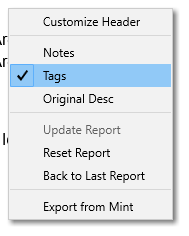

- I Check their rental tag, and Tenant_Responsible tag and check the ‘OR‘ option in the Tags section.

- I check all income and expense categories (that will also show my fake entry for past due rent)

- And last but not least, I check the Rental Deposit category under my Equities Category Type.

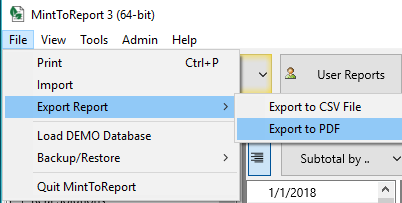

This gives me a nice accounting for both my tenant and myself that I can printout as a PDF or print to put in my rental folder in my file cabinet.

I save three reports as User reports.

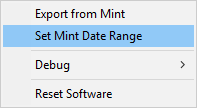

- A monthly tag report selecting the Date Range as Month. This way, each month I can run the report and file it away. And since I used the Date Range there really is nothing to change on the report.

- A Profit and loss report selecting all Property Tags and saving it as also as a month report. It is easy enough to uncheck and check the tags to drill down on individual properties.

- A move out Accounting report. All I need to do to alter this report when a tenant moves out is set the date range to the date the tenant moved out to the date I printed the report. That’s when all repairs are typically done and when I add a fake transaction for past due rent, if any, in Mint. Since the report is a Date Ascending report, it shows the Tenants Deposit first with repairs and past due rent afterward. It Makes an excellent report for you, the tenant and (hopefully not) the court.

I am sure there are other ways to use MintToReport to keep tract of rentals. I am leaving the comments section open for this topic if someone wants to way in.